idaho estate tax return

An inheritance tax return must be filed for the estates of any person who died before October 1 1993. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine.

Banking Suvidha Income Tax Return Itr Pan Aadhaar Tax Saving F Personal Injury Lawyer Injury Lawyer Estate Planning Attorney

In accordance with Sections 63-105 and 14-539 Idaho Code the State Tax.

. A fiduciary must file Form 66 Idaho Fiduciary Income Tax Return when any of the following circumstances apply. Idaho state income tax rates range from 0 to 65. A homeowner with a property in.

You should file the estate tax return to report the sale of the property and to submit a copy of the K-1 schedules to the IRS. 31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can learn. Enter the total of Idaho distributable income from Form PTE-12 columns.

September 22 2022 800 am 23 2022 1200 pm Venue. 100 West Randolph Street. Idaho State Income Taxes for Tax Year 2021 January 1 - Dec.

Letter to Idaho State Tax Commission transmitting Tentative Idaho 345 Transfer and Inheritance Tax Return 29. If the last day for filing any return falls on a Saturday Sunday or legal. 350104 - IDAHO ESTATE AND TRANSFER TAX ADMINISTRATIVE RULES.

Nobody wants to hear from theIRS âand I mean nobody. The Grove Hotel Categories. Include Form PTE-12 with the return if the trust or estate files as a pass-through entity.

Michigans estate tax is not operative as a result of changes in federal law. Treasure Valley Concerned Over Rise in IRS Estate Tax Audits. The information from the federal estate tax return.

IRS Form 1041 US. Learn about New Mexico tax rates for income property sales tax and more to estimate your 2021 taxes. Continuing Legal Education TAX Section Sponsored CLE Taxation.

To put this into perspective a home in Boise Idaho Ada County has a property tax rate of 801. Gross income from Idaho sources of 600 or more for the current tax year. There is an 1170 million million exemption for the federal estate tax for deaths in 2021 increasing to 1206 million in 2022.

Gross income of 600 or more for the current tax year. A return shall be required to be filed with the Commission by every estate that is required by the laws of the. Return it isnt required to file an Idaho return.

Learn about Idaho tax rates for income property sales tax and more to estimate your 2021 taxes. Resident trust including grantor trust Gross income of 100 or. New Mexico state income tax rates range from 0 to 59.

Real estate property tax is collected on the assessed value of real estate real property owned by a business or an individual. Event Details Date. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

Fiduciary Estate - April 15 - Returns are due by the 15th day of the fourth month following the close of the taxable year. Letter to Internal Revenue Service transmitting Federal Estate. Also you are required to file an estate tax return.

Understand typical refund time frames. Idaho has no estate tax. You can expect your refund about seven to eight weeks after you receive an acknowledgment that we have your return.

Please contact the Estate Tax Section Illinois Attorney Generals Office with any questions or problems. Federal Estate Tax. If your estate is large enough you still may have to worry about the federal estate tax though.

Real estate taxes are paid annually or semi. County tax rates range throughout the state. 13 April 2013 Author.

The decedent and their estate are. The North Dakota estate tax is a pickup tax based upon the credit for state death taxes as computed on the federal estate tax return.

You Made A Mistake On Your Tax Return Now What

How To File Taxes For Free In 2022 Money

Here S The Average Irs Tax Refund Amount By State Gobankingrates

It S Tax Day If You Re Preparing For Homeownership This Is A Friendly Reminder That You May Use Your Tax Return Toward Yo In 2022 Tax Day Closing Costs Tax Return

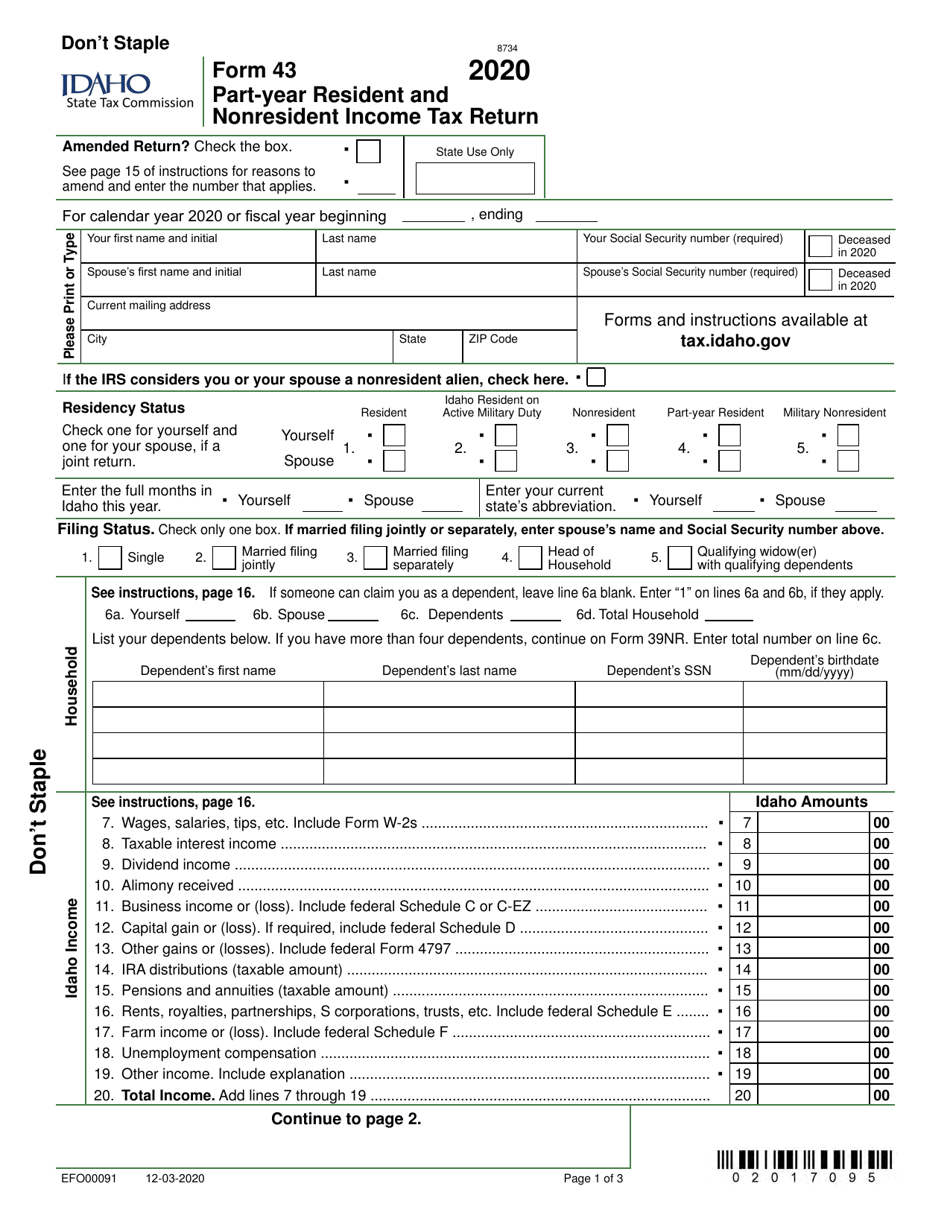

Form 43 Efo00091 Download Fillable Pdf Or Fill Online Part Year Resident And Nonresident Income Tax Return 2020 Idaho Templateroller

Understanding The 1065 Form Scalefactor

:max_bytes(150000):strip_icc()/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

It S Time For Your April Home Checklist This Month Is All About Making The Most Of The Warmer Weather There A In 2022 Florida Real Estate Estate Homes Real Estate

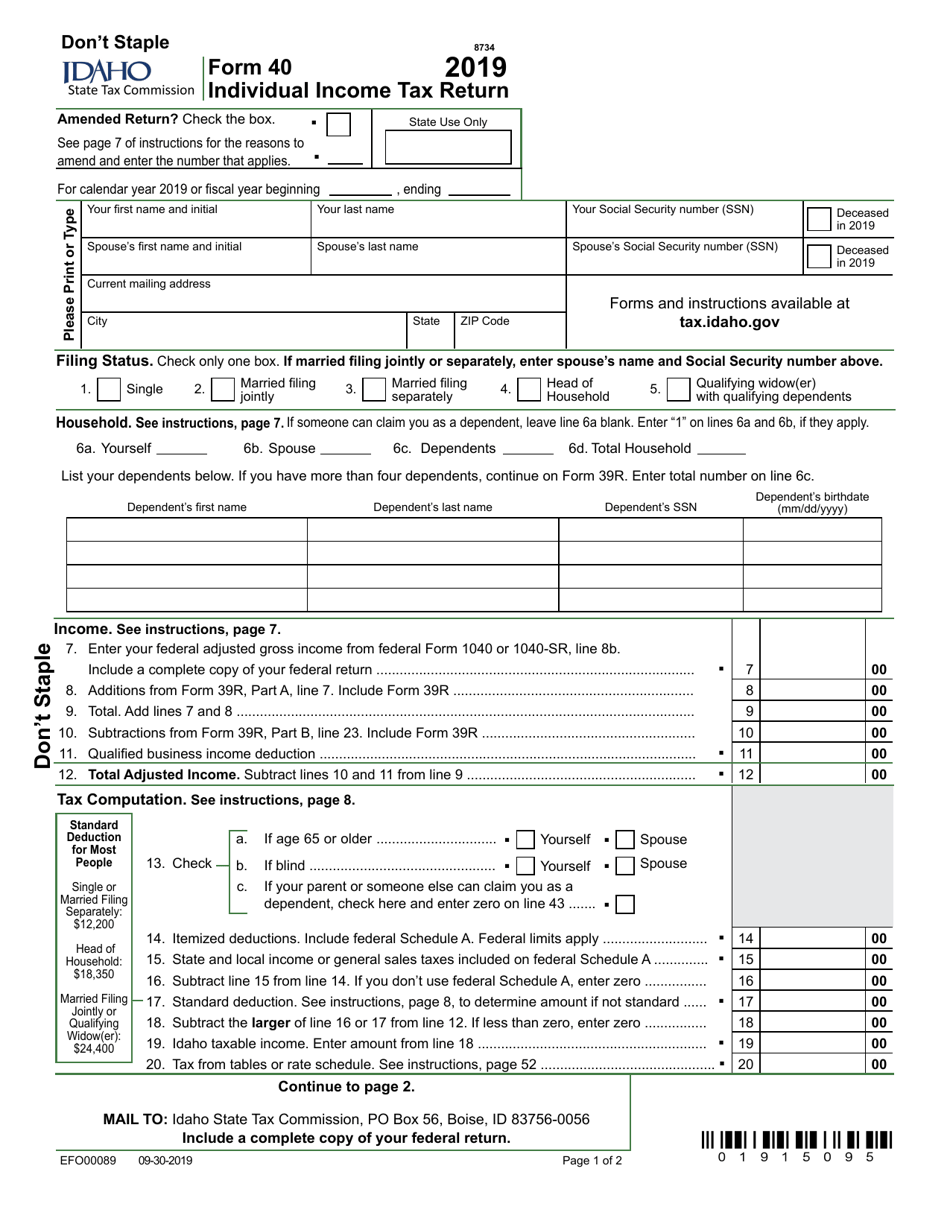

Form 40 Download Fillable Pdf Or Fill Online Individual Income Tax Return 2019 Idaho Templateroller

Will The Irs Extend The Tax Deadline In 2022 Marca

Massachusetts Tax Forms 2021 Printable State Ma Form 1 And Ma Form 1 Instructions

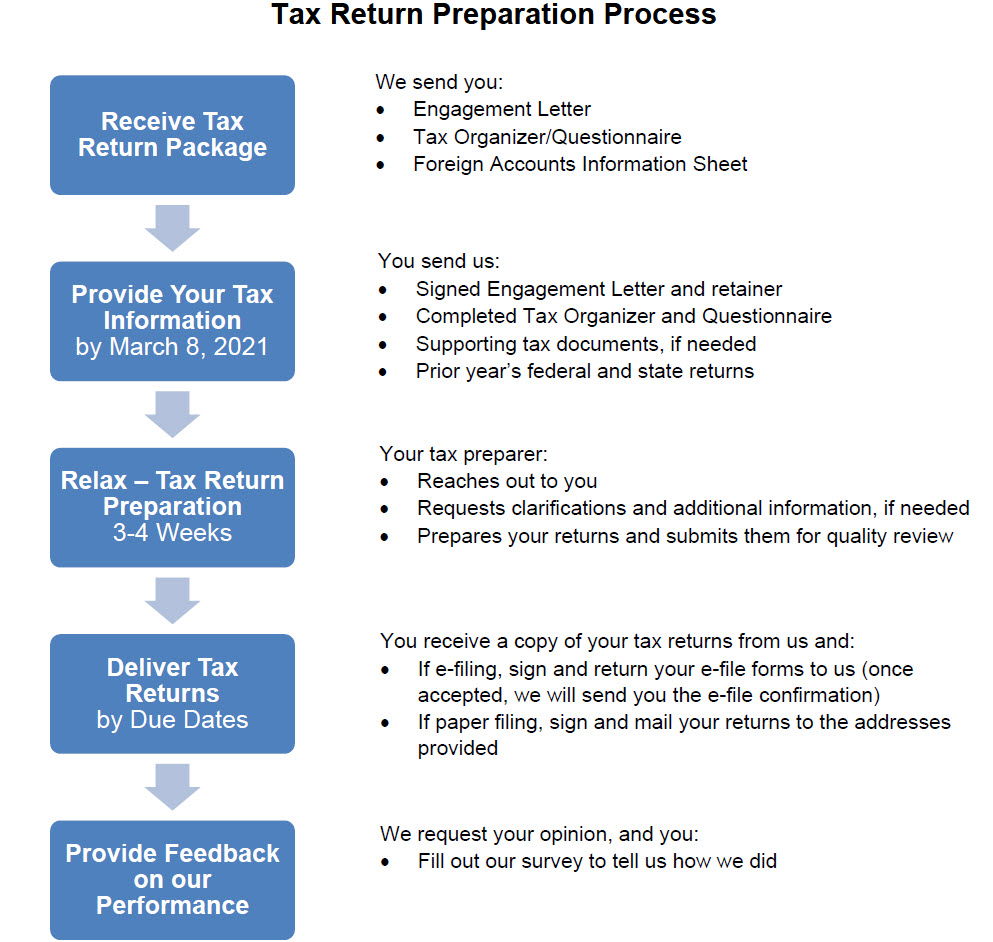

Tax Return Information The Wolf Group

How Your Idaho Income Tax Refund Can Process Faster Tax Refund Tax Help Income Tax

Christmas Cpa Accounting Accounting Firms Tax Services

Filing An Idaho State Tax Return Things To Know Credit Karma Tax